Advertisement

Stock analysis may sound intimidating at first, but it's essentially about learning how to assess a company's value and future performance. For investors, whether new or seasoned, understanding stock analysis provides the foundation to make smarter, more calculated investment choices.

Unlike guesswork, stock analysis offers investors the tools to know how much a stock will grow or stabilize. Here, we will break down the main types of analysis and how each contributes to evaluating a stock's value, giving you a solid starting point for making more informed investment decisions.

Fundamental analysis is the most widely used method for determining a stock's value. It considers the financial health of a company and its prospects. Such an analysis focuses on the numbers related to revenue, earnings, and growth expectations. A stock's "intrinsic value" is a term for its real value that cannot be found through its present market price. Important figures in the fundamental analysis include:

EPS measures profitability by dividing a company's profit by its outstanding shares. The higher the EPS, the stronger the earnings; the more stable the profits, the safer the firm is to invest in. Investors often use EPS to determine a firm's ability to create profit and maintain growth.

This compares a stock's market price with its EPS, allowing insights into valuation. When a high P/E results in overvaluation and a lower P/E results in undervaluation, this ratio can reach a certain conclusion. In brief, this ratio aids the investor in making buy/hold/sell decisions about a stock.

This ratio compares a company's total debt to shareholder equity, explaining its financial leverage. A high debt-to-equity ratio might indicate potential risk in finance; low ratios would mean investors would sense more stability in a company's debt management.

Fundamental analysis helps the investor know where the company stands within the industry and its competitive advantages over the business. This, therefore, forms a strategic approach, which is great for people ready to hold onto stock for the long term, considering strong fundamentals that will beat peers over time.

While fundamental analysis looks at the company's internal value, technical analysis examines stock price movements and trading volume to forecast future trends. This analysis relies on charts and patterns to predict how a stock may perform in the short term based on historical price behavior. Key tools in technical analysis include:

This indicator calculates a stocks average price over a chosen period, such as 50 or 200 days, which helps filter out short-term fluctuations. Moving averages reveal overall price trends, providing investors with insight into long-term directional momentum.

The RSI evaluates a stock's price momentum to signal if its potentially overbought or oversold. A high RSI may indicate overvaluation and caution, while a low RSI suggests possible undervaluation and buying opportunities, making it useful for timing decisions.

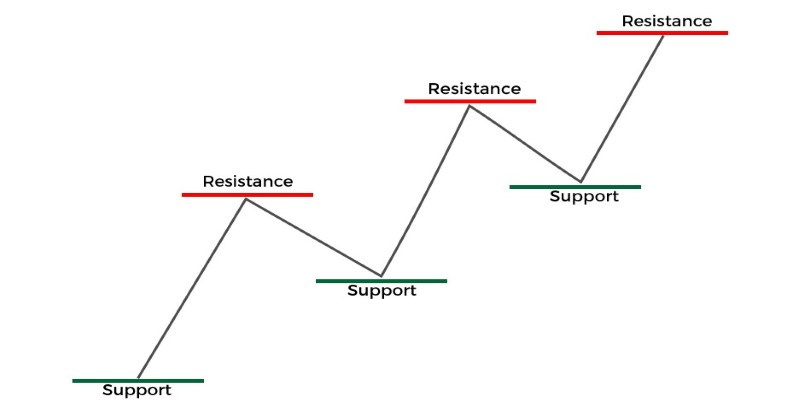

These price levels represent points where a stock often reverses direction. Support signals a lower limit, while resistance marks an upper boundary, guiding investors in choosing strategic entry and exit points for trades.

Technical analysis is often favored by traders focused on short-term gains. By studying trends and using technical indicators, these investors attempt to time their trades based on market sentiment and stock behavior patterns rather than the company's fundamental value.

Many investors combine fundamental and technical analysis for a more comprehensive stock evaluation. This approach, known as "blended analysis," allows investors to consider both the company's financial health and market sentiment. For example, an investor may use fundamental analysis to identify a fundamentally strong stock and then apply technical analysis to determine an optimal time to buy. By blending these methods, investors can make more balanced decisions, especially in volatile or fast-moving markets.

Blended analysis is particularly useful for investors seeking a mix of long-term growth and short-term trading opportunities. By using both methods, investors may find stocks with solid fundamentals that are temporarily undervalued due to market trends, offering a potential "buy low" opportunity. Alternatively, they may identify fundamentally weak stocks that are temporarily in high demand, allowing for short-term gains while managing risk.

Stock analysis also involves understanding broader market trends and economic indicators that can impact an entire industry or sector. Macro factors, such as inflation rates, interest rates, and GDP growth, have a strong influence on stock prices. When the economy is booming, companies typically see increased demand, positively affecting stock prices. Conversely, during economic downturns, even fundamentally strong companies may experience stock price declines.

Investors often watch economic indicators like the Consumer Price Index (CPI), unemployment rate, and interest rate trends to gauge overall market conditions. For example, in periods of low interest rates, stocks tend to perform well as borrowing costs for companies decrease, which can boost profits and drive stock prices higher. Meanwhile, high inflation can impact consumer spending, potentially hurting businesses and affecting stock valuations. Analyzing these factors alongside individual stock analysis can provide a more nuanced perspective and improve investment timing.

Stock analysis plays a crucial role in helping investors make informed decisions. By mastering both fundamental and technical analysis, investors can evaluate a companys value and understand market trends, enabling better timing for buying and selling. Whether aiming for long-term growth or short-term gains, blending these methods with an understanding of economic indicators offers a balanced perspective on market movements.

While stock analysis can't remove all risks, it empowers investors to make choices based on data, reducing reliance on guesswork. Over time, this data-driven approach enhances an investors confidence and ability to navigate the market effectively, adapting to its shifts with greater clarity.

Advertisement

By Kristina Cappetta/Dec 26, 2024

By Georgia Vincent/Nov 05, 2024

By Noa Ensign/Oct 18, 2024

By Nancy Miller/Oct 18, 2024

By Kristina Cappetta/Oct 18, 2024

By Alison Perry/Oct 18, 2024

By Mason Garvey/Jan 01, 2025

By Sean William/Jan 01, 2025

By Martina Wlison/Oct 18, 2024

By Susan Kelly/Dec 13, 2024

By Christin Shatzman/Oct 10, 2024

By Gabrielle Bennett /Oct 10, 2024